+86-769-38973158

+86-769-38973158 +86 13622624429

+86 13622624429 machinery_vk@21cn.com

machinery_vk@21cn.com

+86-769-38973158

+86-769-38973158 +86 13622624429

+86 13622624429 machinery_vk@21cn.com

machinery_vk@21cn.comViews: 11 Author: Site Editor Publish Time: Apr 23,2025 Origin: Site

1、 Production and market pattern

Total production and global status:

China's forging production has been ranked first in the world for several consecutive years, with production recovering to 13.708 million tons in 2023 and expected to maintain stable growth in 2025. Automotive forging remains the core driving force.

China accounts for nearly 40% of the global forging production, leading the global supply chain.

Application field distribution:

Automobile, aerospace, and engineering machinery are the three core fields. Among them, the demand for high-temperature alloys and titanium alloy forgings in the aerospace industry has surged, but the technology concentration of domestic enterprises is relatively low, and only a few enterprises have the production capacity for high-end products.

Technical upgrade direction:

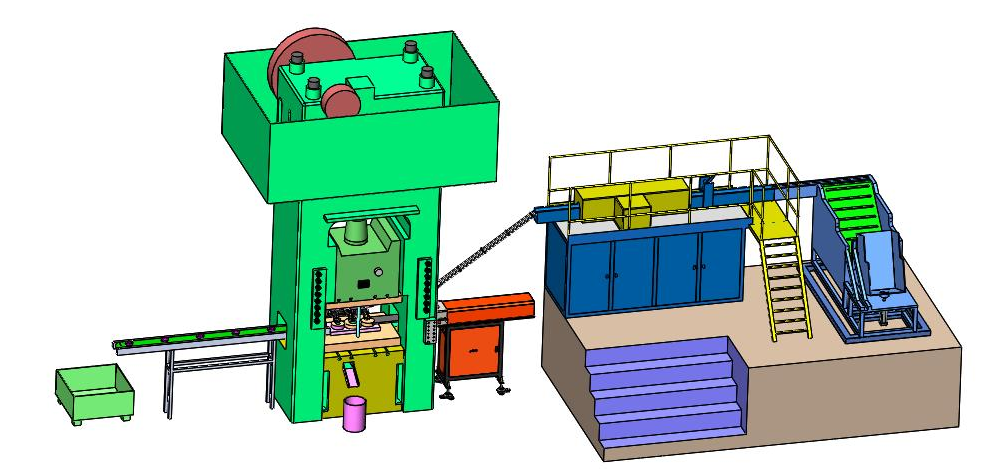

The trend towards large-scale, automated, and intelligent equipment is evident, driving an increase in the proportion of high-end products such as precision ring forgings.

The technical requirements for aviation forgings are high, involving interdisciplinary technology integration. Domestic enterprises still lag behind international standards by 1-2 levels in terms of raw material utilization rate (only 10% -15%) and precision forming technology.

2、 Expansion of high-end material applications

Growth in demand for lightweight alloys: New energy vehicles are driving the demand for lightweight aluminum and magnesium alloy forgings, such as Fityou forging robot for forging automaticPrecision Forging Project"

Aviation special materials: High temperature alloys and titanium alloy forgings have seen a significant increase in their application in domestic large aircraft and aviation engines. The market size of aviation forgings is expected to exceed 140 billion yuan by 2025.

Market structure optimization and concentration enhancement

Accelerated industry integration: Leading companies such asFityou robot and Parker New Materials have expanded their production capacity through technological upgrades, with the top ten companies having a market share of over80%. The "internal competition" in the mid to low end market has forced the industry to reshuffle.

High end market dominance: High value-added fields such as aviation and new energy vehicles have become profit cores, with a compound growth rate of 5% -6% for aviation forgings by 2025, far higher than traditional fields.

6、 Release of demand in emerging application fields

New energy vehicle drive: Automotive forgings account for over 60%, and the trend towards electrification is driving an increase in demand for lightweight components such as shock absorbers and transmission gears.